Green issuance rebounded in second quarter after volatile start to 2022

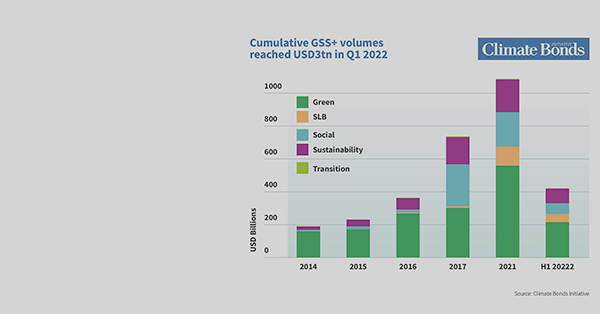

The Climate Bonds Initiative (CBI) released its first half (1H) 2022 report on the green, social, sustainable, sustainability-linked and transitional (GSS+) debt market, which reached a combined volume of $417.8 billion. These figures show a year-on-year decrease of 27%, however the second quarter (Q2) increased by 25% over Q1 volumes.

The green label continues to represent the largest share (52%) in the GSS+ debt market, totaling $218.1 billion in 1H-2022. The majority of the largest green bonds issued in this period were from sovereign issuers and supranational bodies.

The volume of social label bonds was down 57% y-o-y in 1H-2022, as the sharp increase in this label in 2021 was largely related to mitigating the most urgent impacts of the COVID-19 pandemic.

The sustainability-linked bond (SLB) market continued to grow in 1H-2022, with new and recurring issuers using the format to define and signal to investors their transition pathways.

As a final summary, CBI concludes that despite the difficult backdrop, signs of a rebound emerged in Q2 and expects a steady recovery to continue throughout the remainder of 2022.

Stay updated on the latest trends of Green Finance

Stay updated on the latest trends of Green Finance